Zuum has ceased operations and recommends Rival IQ for your social media analytics and competitive tracking needs.

Try Rival IQ for freeMore than 500 companies and agencies trust Rival IQ to help them make smarter social media analysis decisions, faster.

Quickly create insightful social media reports

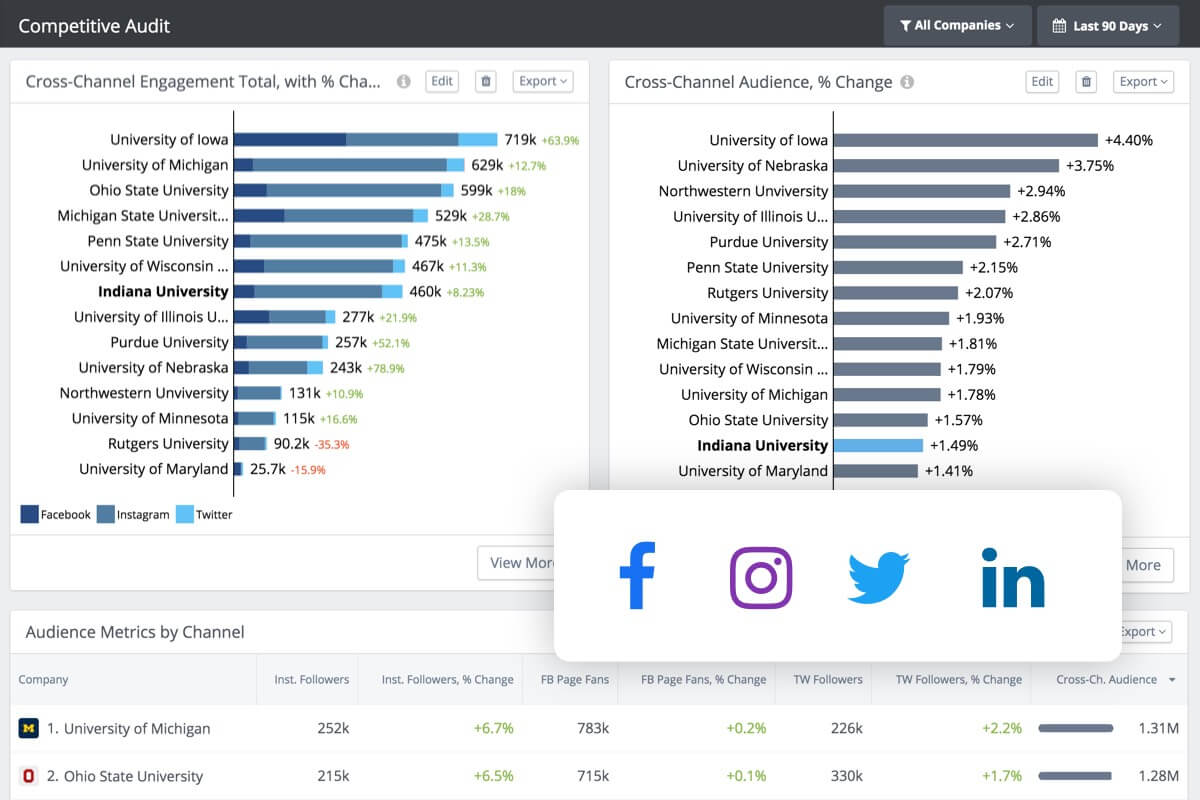

With easy access to all the social, SEO, and web data you need, you can focus on performing your audit instead of hunting for data. With Rival IQ, you have data from six major social channels, paid social media on Facebook and Instagram, and keyword and link data from SEMrush and Moz.

Because we’ve integrated your competitors’ performance directly into Rival IQ, you’ll create benchmarks and discover competitive insights without lifting a finger.

Dive deeper with powerful social analysis

You’ll see what’s really working for your social media with our rich suite of metrics and research tools.

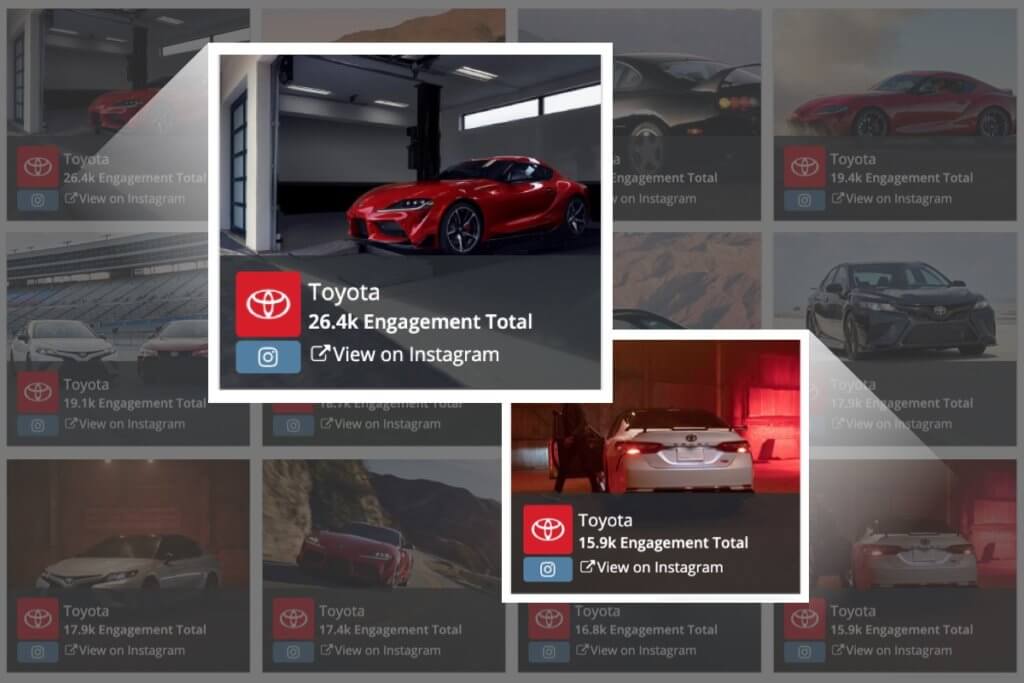

Best / Worst-Performing Content

Uncover the topics, images, and themes that resonate with your audience.

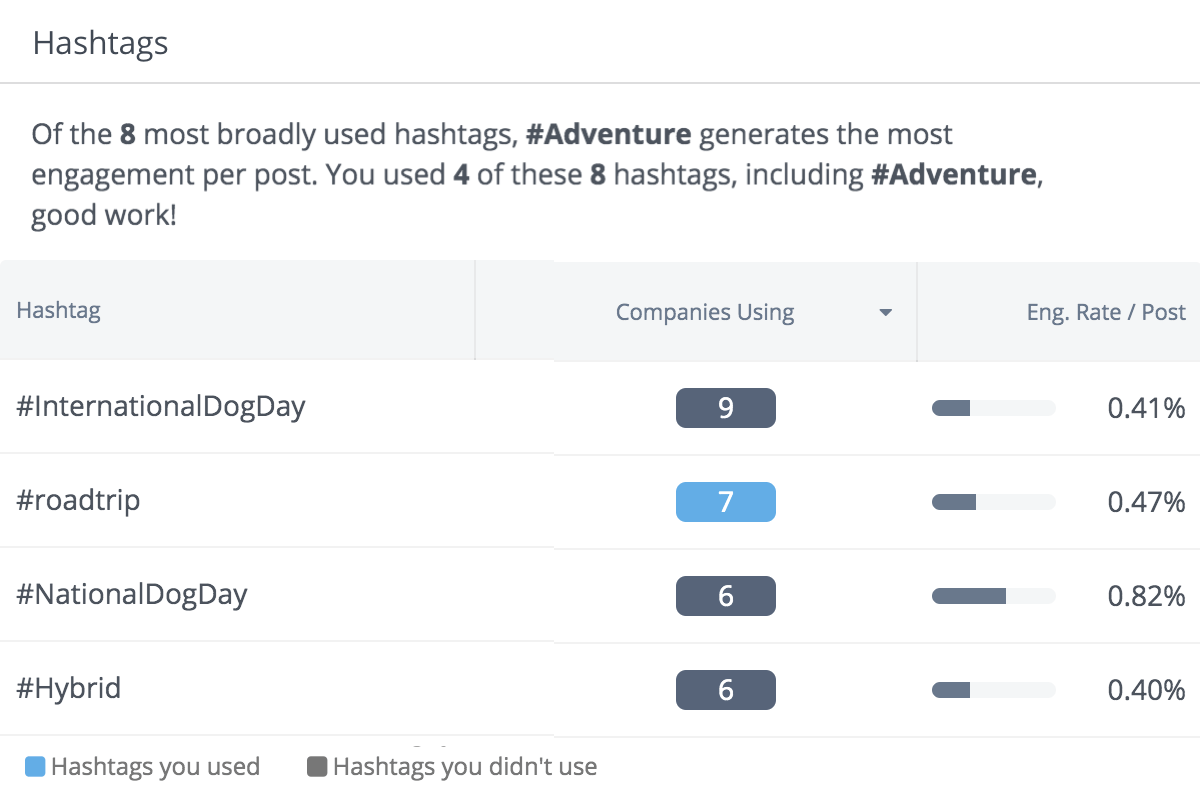

Hashtag Analytics

Whether you’re analyzing your hashtags or the competition’s, dig into their performance and the posts behind the tags.

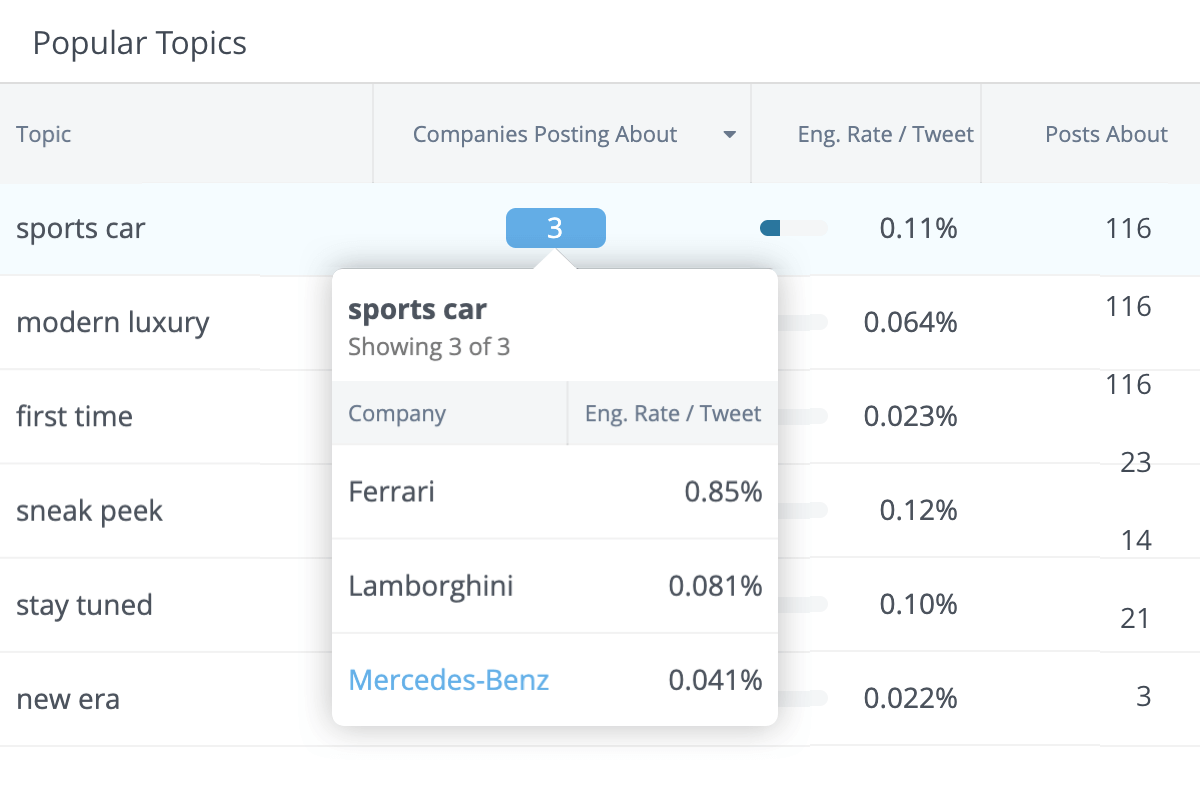

Popular Topics

Find the phrases and topics that drive social engagement in your landscape.

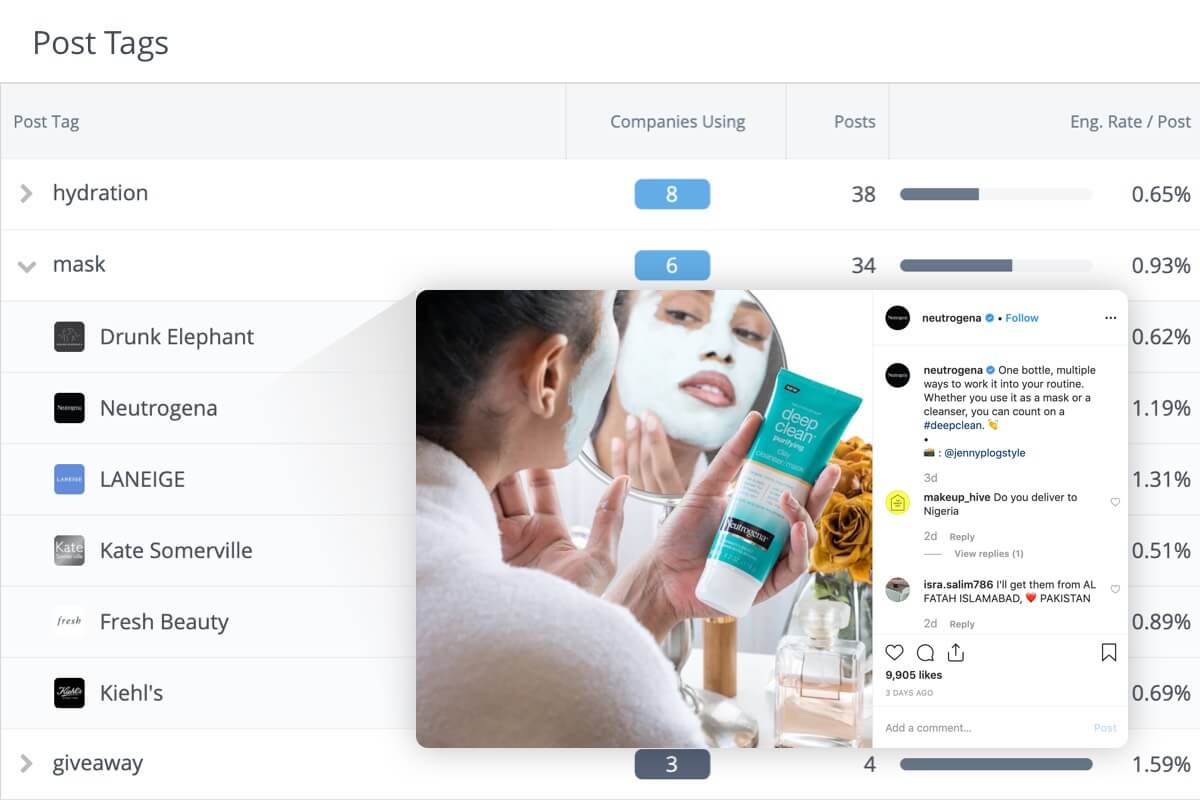

Social Post Tagging

Measure anything, from campaigns to influencer mentions to dogs vs. cats using post tagging.